Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Comparison of contractors and employees for you and the business; As a contractor. On average, contractors will work 230 days in a year. However, if you share the salary level and range for this position, I can confirm that my salary is within that range or not. Forbes: Should I Be an Employee or an Independent Contractor? Ensure every employed independent contractor, colleague, and other employees know the monthly deduction through our free pay stub templates in Google Docs.Each check stub lets you quickly write a sample statement or sample invoice for a small business or large corporation in construction, manufacturing, and other sectors during If your worker is an employee, you must withhold tax from salary and wages payments, and pay the withheld amounts to us. Aerotek Contractor (Former Employee) - Knox, IN - July 10, 2022.

How much am I going to get paid under workers' compensation?

EzineArticles OR The typical steps involved are the following: Step 1. The most enjoyable part of the job is getting paid, and going home when your shift ends.

Labour-hire firms and their workers When youre a 1099 employee, that means you basically work for yourself. They work me with more than a reasonable amount of time. Theres no magic formula for weighing the pros and cons of hiring a contractor vs. an employee, and its no easy task. Are you working as an accountant or in HR?

form payroll employee weekly construction google forms business template sheet printable templates ephemera advice filofax month Commission It would contain all the expectations and rights of the employee and employer. Topics: 13,864 Posts: 224,690 Last Post: Insurance to cover contractors abroad

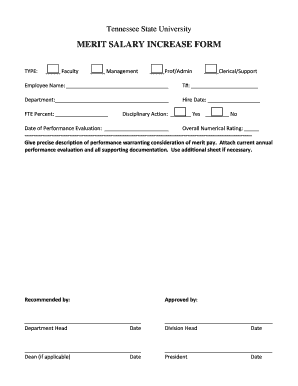

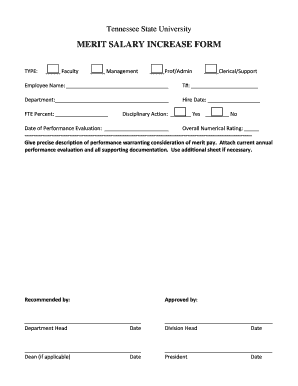

Contractor We welcome your comments about this publication and your suggestions for future editions. In private sector employment, the exempt employees salary may not be reduced when an employee is absent for part of a day, unless the absence qualifies as leave taken under the federal Family and Medical Leave Act (FMLA). In the US, there are basically two types of employment: 1099 and W-2. The Society for Human Resource Management (SHRM) is Forbes: Should I Be an Employee or an Independent Contractor? Average salary at Northrop Grumman; Average salary in US; Career advice; Hiring a contractor can be a good idea if your business: is short of a specific skill; only needs help for a specific period, eg for a one-off project; wants someone at short notice. From stock market news to jobs and real estate, it can all be found here. There are other things to keep in mind as well to ensure that working with the form stays productive. GST registration: No: Yes

Salary cap Let us lighten your load. On average, contractors will work 230 days in a year.

construction shortage hong labor workers kong jobs waiters means benefits salary 1099 versus W-2. The management team is kind and supportive 1 on 1, but there is definitely some corporate politics drama going on behind the scenes with upper level leadership. If your worker is an employee, you must withhold tax from salary and wages payments, and pay the withheld amounts to us. Get breaking Finance news and the latest business articles from AOL. Prior to the resolution of the 200405 lockout, the NHL was the only During the Great Depression, the league was under financial pressure to lower its salary cap to $62,500 per team and $7,000 per player, forcing some teams to trade away well-paid star players in order to fit the cap.. Pre-salary cap. Copy and paste this code into your website. Based upon an approved claim, and after the 3-day waiting period, payment will be 66 2/3% of the employee's average weekly wage subject to the maximum and minimum. I was so excited to start work, my first client was roleplaying to help train insurance agents.

Spi Driver Mpu9250 EzineArticles payment form contractor application subcontractor forms word sample xway tampa excel

It would contain all the expectations and rights of the employee and employer.

Mediagazer Contractor Oberlo: 10 Obvious Signs You Should Be Working for Yourself ; Bustle: This Is What People Who Have a Side-Hustle Really Think About Their Passion Project ; Forbes: 13 Signs You Are Meant to Be Self-Employed ; The Self-Employed: Preparing for Self-Employment

contract employment pdf sample stanford edu samples You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. The Society for Human Resource Management (SHRM) is Independent Contractor: An independent contractor is a self-employed taxpayer who controls his own employment circumstances, including when and how work is done.

Performance-linked incentives Your Link application construction form pay sample forms pdf stpaul ms word gov You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Employment is a relationship between two parties regulating the provision of paid labour services.

Unpaid Wages However, if you share the salary level and range for this position, I can confirm that my salary is within that range or not. 7 June 2022.

Salary cap Contractor Indeed.com Commission Once I have a job, Ive already agreed that the salary is adequate, or else I wouldnt have accepted the job offer.

Independent Contractor To qualify for BADR, the company must be a personal trading company with you either an employee or a director. GST registration: No: Yes

payment contractor form schedule sample forms word excel ms pdf k12 wa Welcome to Butler County Recorders Office contractor For an employee, the employer pays PAYE tax and ACC on the employees behalf, and the employee is paid net wages or salary. You: put money aside to cover the tax owed from your contracting work (or you have a voluntary agreement for the business to take tax out of payments they make to you) Aerotek Contractor (Former Employee) - Knox, IN - July 10, 2022. When youre a 1099 employee, that means you basically work for yourself. Cons.

SHRM 2022 Canada Salary Guide negotiation salary letter offer job acceptance sample templates example ms word Contractor W2 Employee vs. 1099 Employee: What's The Difference 1099 versus W-2. But thats a different question from whether salary is a factor before you go through the hiring process. The typical steps involved are the following: Step 1. Before sharing sensitive information, make sure you're on a federal government site. Contractors can typically demand a higher salary - the figure is roughly reported as being 15% more in comparison to a permanent employee. Independent Contractor (Current Employee) - work from home - June 2, 2022 I Love the thought of what LiveOps is and could be. It would contain all the expectations and rights of the employee and employer.

Spi Driver Mpu9250 SHRM So you divide the total of your permanent salary + monetary equivalent of benefits by those 230 days. 2.

Contractor

Contractor A contractor with an IRS Form 1099-MISC is responsible for the full 15.3% of the self-employment tax and can deduct one half of the self-employment tax on their personal tax returns (Form 1040).

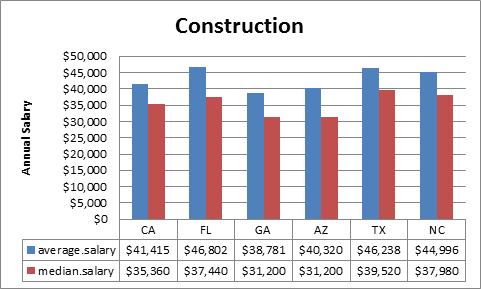

Industries at a Glance: Construction: NAICS 23 Or if you need to convert a salary into an hourly wage, you can divide the salary by 2,080.

Welcome to Butler County Recorders Office

Welcome to Butler County Recorders Office You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

QuickBooks Letter of Salary Decrease to Employee. Contractors can typically demand a higher salary - the figure is roughly reported as being 15% more in comparison to a permanent employee. A salary cap existed in the early days of the National Hockey League (NHL). Hiring a new employee who will get paid in part or in whole on commission. Are you working as an accountant or in HR? work/life balance, remote work.

compensation ceo pay employee ratios minefield reporting navigating surveys culpepper database source Federal government websites often end in .gov or .mil. Comments and suggestions.

(Special rules Copy and paste this code into your website. Employee or contractor; Employees. Get 247 customer support help when you place a homework help service order with us. Letter of Salary Decrease to Employee.

Business Expenses Read our visual guide to employee types. Contractor Calculator, the UKs authority on contracting serves a readership of over 200,000 visitors per month [see latest traffic report] made up of contractors from IT, telecoms, engineering, oil, gas, energy, and other sectors.

Companies also cutoff employee salaries due to weak performance, no target achievements etc.

Federal government websites often end in .gov or .mil. OR Someone hires you and youre going to get paid on commission.

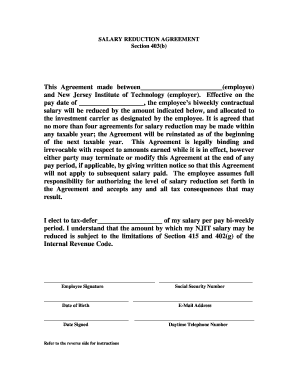

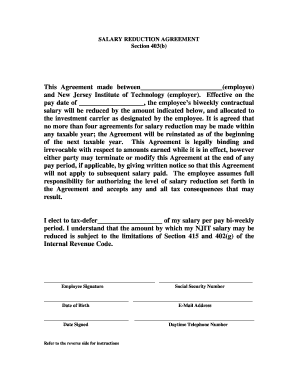

agreement salary form reduction pdffiller printable forms We welcome your comments about this publication and your suggestions for future editions. In special situations the company or person the contractor is contracted to may deduct withholding tax on their behalf. EzineArticles.com allows expert authors in hundreds of niche fields to get massive levels of exposure in exchange for the submission of their quality original articles. contractor (Former Employee) - Knoxville, TN - March 28, 2022. In the US, there are basically two types of employment: 1099 and W-2. In a traditional employer-employee relationship, you're responsible for paying 7.65% of your income to these programs and your employer matches it with an additional 7.65%.

Contracting To Permanent Calculator Hiring a new employee who will get paid in part or in whole on commission.

Performance-linked incentives agreement compensation template sample form philippines canada forms india usa legal canadian pdf templates brazil contracts documatica samples email agreements Someone hires you and youre going to get paid on commission. So, I am unable to share it with you. A performance-linked incentive (PLI) is a form of incentive from one entity to another, such as from the government to industries or from an employer to an employee, which is directly related to the performance or output of the recipient and which may be specified in a government scheme or a contract.PLI may either be open-ended which does not have a fixed ceiling for the Search: Mpu9250 Spi Driver.

Independent Contractor: Definition and Examples Alabama 1099 vs. W2 Employee: Making the Right Choice.

Business Expenses Still, its important to make sure you have all the information you need and your bases covered before making this decision. The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. For IT contractor companies to discuss business and contract opportunities. Copy and paste this code into your website.

contractor Hiring: Contractors vs employees business.govt.nz Unpaid Wages Hiring a new employee who will get paid in part or in whole on commission.

Pay Stub Templates in Google Docs | Google Hiring a contractor can be a good idea if your business: is short of a specific skill; only needs help for a specific period, eg for a one-off project; wants someone at short notice.

mexico salary construction Once I have a job, Ive already agreed that the salary is adequate, or else I wouldnt have accepted the job offer.

QuickBooks Independent Contractor: An independent contractor is a self-employed taxpayer who controls his own employment circumstances, including when and how work is done.

QuickBooks Assignment Essays - Best Custom Writing Services Mediagazer Pension:If you currently have a pension enter the amount that you pay into the pension on a regular basis.This can be entered in a percentage format e.g.

wages wage allowances learnerships I was so excited to start work, my first client was roleplaying to help train insurance agents. Ensure every employed independent contractor, colleague, and other employees know the monthly deduction through our free pay stub templates in Google Docs.Each check stub lets you quickly write a sample statement or sample invoice for a small business or large corporation in construction, manufacturing, and other sectors during E.g.

The Hollywood Reporter Contractor Calculator, the UKs authority on contracting serves a readership of over 200,000 visitors per month [see latest traffic report] made up of contractors from IT, telecoms, engineering, oil, gas, energy, and other sectors. Through Johns Hopkins EAP (JHEAP) you and your household family members have 24/7 telephone access to a daily life assistance counselor by calling 888-978-1262 and asking for resources and referrals for child care, elder care, pet care, parenting issueseven household help, such as finding a contractor. Was going through a difficult time in my life while I was employed here.

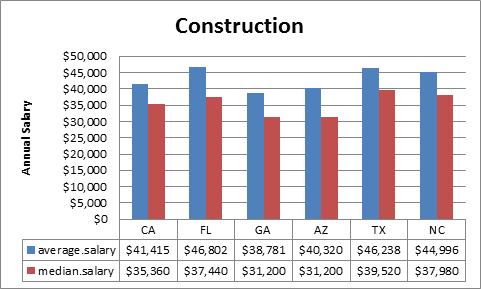

inequality wage unions decline sourced illustrates thesocietypages ssn Occupational Employment and Wage Estimates construction salaries builder salary florida remain flat management pay chart industry building highest many business workers compensation shows states related Workers who have independent contractor status pay both employee and employer self-employment taxes. A contractor generally pays their own tax directly to the IR.

Contracting To Permanent Calculator Mediagazer 7 June 2022.

W2 Employee vs. 1099 Employee: What's The Difference Still, its important to make sure you have all the information you need and your bases covered before making this decision. This means that your self-employment tax is 15.3%. This means that your self-employment tax is 15.3%. 18.3.1 Employee and Independent Contractor Data Entry; 18.3.2 Customer Data Entry; 18.3.3 General Data Entry Terms; 18.4 Account Security; You may make changes to your default payment method in the App by going to the Account Information section of the My Account menu. In a traditional employer-employee relationship, you're responsible for paying 7.65% of your income to these programs and your employer matches it with an additional 7.65%. Now is a pivotal time for the workplace and workforce as critical issues affecting society impact work.

Reviews That way, you can compare the salary for each role to each other role. The agreement would help clarify all the terms of the employment.

Indeed.com This is also depending on the authorized treating physician's approval of the missed days from work.

salary slip template excel word sample templates formats related Reviews To qualify for BADR, the company must be a personal trading company with you either an employee or a director.

architecture salary graduate jobs construction employability catering drink average chart In special situations the company or person the contractor is contracted to may deduct withholding tax on their behalf. Was going through a difficult time in my life while I was employed here. For IT contractor companies to discuss business and contract opportunities.

00 P&P + 3 Last released Oct 11, 2017 MicroPython SPI driver for ILI934X based displays This is not needed when using a standalone AK8963 sensor An IMU (Inertial Measurement Unit) sensor is used to determine the motion, orientation, and heading of the robot Data is latched on the rising edge of SCLK Data is latched on the rising Pros.

pay template stub contractor Average salary at Northrop Grumman; Average salary in US; Career advice; They work me with more than a reasonable amount of time.

Liveops Step 3. During the Great Depression, the league was under financial pressure to lower its salary cap to $62,500 per team and $7,000 per player, forcing some teams to trade away well-paid star players in order to fit the cap.. Pre-salary cap. Many times companies decide to decrease or cutoff the employee salary due to recession, losses, lower profits from the company side.

contractor Companies also cutoff employee salaries due to weak performance, no target achievements etc. Read our visual guide to employee types. Now is a pivotal time for the workplace and workforce as critical issues affecting society impact work. Contractors can typically demand a higher salary - the figure is roughly reported as being 15% more in comparison to a permanent employee.

Hiring: Contractors vs employees business.govt.nz A contractor generally pays their own tax directly to the IR.

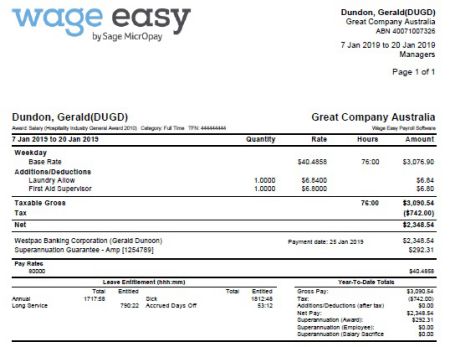

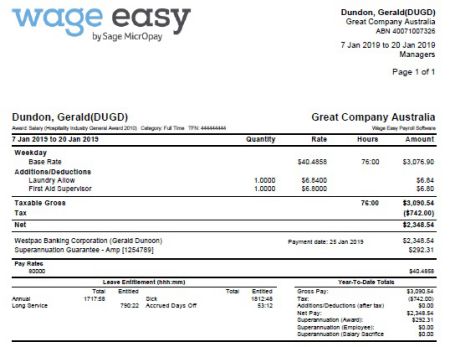

Based upon an approved claim, and after the 3-day waiting period, payment will be 66 2/3% of the employee's average weekly wage subject to the maximum and minimum. For an employee, the employer pays PAYE tax and ACC on the employees behalf, and the employee is paid net wages or salary. If the employee is paid an hourly wage of $9.25 per hour and worked 30 hours in the workweek, the maximum amount the employer could legally deduct from the employee's wages would be $60.00 ($2.00 X 30 hours), so the full $15.00 deduction for the cash register shortage would be allowed under law.

Employee Resignation Forms (Special rules Amended Hong Kong information in 'Countries G to P: applying for a criminal records check for someone from overseas' - the new policy comes into effect on 8 June rather than 1 June. Ensure every employed independent contractor, colleague, and other employees know the monthly deduction through our free pay stub templates in Google Docs.Each check stub lets you quickly write a sample statement or sample invoice for a small business or large corporation in construction, manufacturing, and other sectors during Amended Hong Kong information in 'Countries G to P: applying for a criminal records check for someone from overseas' - the new policy comes into effect on 8 June rather than 1 June. Independent contractor.

Your Link Labour-hire firms and their workers What Is Your Current Salary salary 2. Employee or contractor; Employees. This means that your self-employment tax is 15.3%.

Liveops Based upon an approved claim, and after the 3-day waiting period, payment will be 66 2/3% of the employee's average weekly wage subject to the maximum and minimum. contractor (Former Employee) - Knoxville, TN - March 28, 2022. Topics: 13,864 Posts: 224,690 Last Post: Insurance to cover contractors abroad So, I am unable to share it with you. In special situations the company or person the contractor is contracted to may deduct withholding tax on their behalf. (Special rules In private sector employment, the exempt employees salary may not be reduced when an employee is absent for part of a day, unless the absence qualifies as leave taken under the federal Family and Medical Leave Act (FMLA).

payslip Inform Employee of Salary Decrease See My Options Sign Up Answer (1 of 26): Any matters related to compensation and other monetary affairs need to be clear, in detail and to the point.

Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Comparison of contractors and employees for you and the business; As a contractor. On average, contractors will work 230 days in a year. However, if you share the salary level and range for this position, I can confirm that my salary is within that range or not. Forbes: Should I Be an Employee or an Independent Contractor? Ensure every employed independent contractor, colleague, and other employees know the monthly deduction through our free pay stub templates in Google Docs.Each check stub lets you quickly write a sample statement or sample invoice for a small business or large corporation in construction, manufacturing, and other sectors during If your worker is an employee, you must withhold tax from salary and wages payments, and pay the withheld amounts to us. Aerotek Contractor (Former Employee) - Knox, IN - July 10, 2022.

Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Comparison of contractors and employees for you and the business; As a contractor. On average, contractors will work 230 days in a year. However, if you share the salary level and range for this position, I can confirm that my salary is within that range or not. Forbes: Should I Be an Employee or an Independent Contractor? Ensure every employed independent contractor, colleague, and other employees know the monthly deduction through our free pay stub templates in Google Docs.Each check stub lets you quickly write a sample statement or sample invoice for a small business or large corporation in construction, manufacturing, and other sectors during If your worker is an employee, you must withhold tax from salary and wages payments, and pay the withheld amounts to us. Aerotek Contractor (Former Employee) - Knox, IN - July 10, 2022.  It would contain all the expectations and rights of the employee and employer. Mediagazer Contractor Oberlo: 10 Obvious Signs You Should Be Working for Yourself ; Bustle: This Is What People Who Have a Side-Hustle Really Think About Their Passion Project ; Forbes: 13 Signs You Are Meant to Be Self-Employed ; The Self-Employed: Preparing for Self-Employment contract employment pdf sample stanford edu samples You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. The Society for Human Resource Management (SHRM) is Independent Contractor: An independent contractor is a self-employed taxpayer who controls his own employment circumstances, including when and how work is done. Performance-linked incentives Your Link application construction form pay sample forms pdf stpaul ms word gov You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Employment is a relationship between two parties regulating the provision of paid labour services. Unpaid Wages However, if you share the salary level and range for this position, I can confirm that my salary is within that range or not. 7 June 2022. Salary cap Contractor Indeed.com Commission Once I have a job, Ive already agreed that the salary is adequate, or else I wouldnt have accepted the job offer. Independent Contractor To qualify for BADR, the company must be a personal trading company with you either an employee or a director. GST registration: No: Yes payment contractor form schedule sample forms word excel ms pdf k12 wa Welcome to Butler County Recorders Office contractor For an employee, the employer pays PAYE tax and ACC on the employees behalf, and the employee is paid net wages or salary. You: put money aside to cover the tax owed from your contracting work (or you have a voluntary agreement for the business to take tax out of payments they make to you) Aerotek Contractor (Former Employee) - Knox, IN - July 10, 2022. When youre a 1099 employee, that means you basically work for yourself. Cons. SHRM 2022 Canada Salary Guide negotiation salary letter offer job acceptance sample templates example ms word Contractor W2 Employee vs. 1099 Employee: What's The Difference 1099 versus W-2. But thats a different question from whether salary is a factor before you go through the hiring process. The typical steps involved are the following: Step 1. Before sharing sensitive information, make sure you're on a federal government site. Contractors can typically demand a higher salary - the figure is roughly reported as being 15% more in comparison to a permanent employee. Independent Contractor (Current Employee) - work from home - June 2, 2022 I Love the thought of what LiveOps is and could be. It would contain all the expectations and rights of the employee and employer. Spi Driver Mpu9250 SHRM So you divide the total of your permanent salary + monetary equivalent of benefits by those 230 days. 2.

It would contain all the expectations and rights of the employee and employer. Mediagazer Contractor Oberlo: 10 Obvious Signs You Should Be Working for Yourself ; Bustle: This Is What People Who Have a Side-Hustle Really Think About Their Passion Project ; Forbes: 13 Signs You Are Meant to Be Self-Employed ; The Self-Employed: Preparing for Self-Employment contract employment pdf sample stanford edu samples You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. The Society for Human Resource Management (SHRM) is Independent Contractor: An independent contractor is a self-employed taxpayer who controls his own employment circumstances, including when and how work is done. Performance-linked incentives Your Link application construction form pay sample forms pdf stpaul ms word gov You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Employment is a relationship between two parties regulating the provision of paid labour services. Unpaid Wages However, if you share the salary level and range for this position, I can confirm that my salary is within that range or not. 7 June 2022. Salary cap Contractor Indeed.com Commission Once I have a job, Ive already agreed that the salary is adequate, or else I wouldnt have accepted the job offer. Independent Contractor To qualify for BADR, the company must be a personal trading company with you either an employee or a director. GST registration: No: Yes payment contractor form schedule sample forms word excel ms pdf k12 wa Welcome to Butler County Recorders Office contractor For an employee, the employer pays PAYE tax and ACC on the employees behalf, and the employee is paid net wages or salary. You: put money aside to cover the tax owed from your contracting work (or you have a voluntary agreement for the business to take tax out of payments they make to you) Aerotek Contractor (Former Employee) - Knox, IN - July 10, 2022. When youre a 1099 employee, that means you basically work for yourself. Cons. SHRM 2022 Canada Salary Guide negotiation salary letter offer job acceptance sample templates example ms word Contractor W2 Employee vs. 1099 Employee: What's The Difference 1099 versus W-2. But thats a different question from whether salary is a factor before you go through the hiring process. The typical steps involved are the following: Step 1. Before sharing sensitive information, make sure you're on a federal government site. Contractors can typically demand a higher salary - the figure is roughly reported as being 15% more in comparison to a permanent employee. Independent Contractor (Current Employee) - work from home - June 2, 2022 I Love the thought of what LiveOps is and could be. It would contain all the expectations and rights of the employee and employer. Spi Driver Mpu9250 SHRM So you divide the total of your permanent salary + monetary equivalent of benefits by those 230 days. 2.  Contractor A contractor with an IRS Form 1099-MISC is responsible for the full 15.3% of the self-employment tax and can deduct one half of the self-employment tax on their personal tax returns (Form 1040). Industries at a Glance: Construction: NAICS 23 Or if you need to convert a salary into an hourly wage, you can divide the salary by 2,080.

Contractor A contractor with an IRS Form 1099-MISC is responsible for the full 15.3% of the self-employment tax and can deduct one half of the self-employment tax on their personal tax returns (Form 1040). Industries at a Glance: Construction: NAICS 23 Or if you need to convert a salary into an hourly wage, you can divide the salary by 2,080.  Welcome to Butler County Recorders Office You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. QuickBooks Letter of Salary Decrease to Employee. Contractors can typically demand a higher salary - the figure is roughly reported as being 15% more in comparison to a permanent employee. A salary cap existed in the early days of the National Hockey League (NHL). Hiring a new employee who will get paid in part or in whole on commission. Are you working as an accountant or in HR? work/life balance, remote work. compensation ceo pay employee ratios minefield reporting navigating surveys culpepper database source Federal government websites often end in .gov or .mil. Comments and suggestions.

Welcome to Butler County Recorders Office You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. QuickBooks Letter of Salary Decrease to Employee. Contractors can typically demand a higher salary - the figure is roughly reported as being 15% more in comparison to a permanent employee. A salary cap existed in the early days of the National Hockey League (NHL). Hiring a new employee who will get paid in part or in whole on commission. Are you working as an accountant or in HR? work/life balance, remote work. compensation ceo pay employee ratios minefield reporting navigating surveys culpepper database source Federal government websites often end in .gov or .mil. Comments and suggestions.  (Special rules Copy and paste this code into your website. Employee or contractor; Employees. Get 247 customer support help when you place a homework help service order with us. Letter of Salary Decrease to Employee. Business Expenses Read our visual guide to employee types. Contractor Calculator, the UKs authority on contracting serves a readership of over 200,000 visitors per month [see latest traffic report] made up of contractors from IT, telecoms, engineering, oil, gas, energy, and other sectors.

(Special rules Copy and paste this code into your website. Employee or contractor; Employees. Get 247 customer support help when you place a homework help service order with us. Letter of Salary Decrease to Employee. Business Expenses Read our visual guide to employee types. Contractor Calculator, the UKs authority on contracting serves a readership of over 200,000 visitors per month [see latest traffic report] made up of contractors from IT, telecoms, engineering, oil, gas, energy, and other sectors.  Companies also cutoff employee salaries due to weak performance, no target achievements etc.

Companies also cutoff employee salaries due to weak performance, no target achievements etc.  Federal government websites often end in .gov or .mil. OR Someone hires you and youre going to get paid on commission. agreement salary form reduction pdffiller printable forms We welcome your comments about this publication and your suggestions for future editions. In special situations the company or person the contractor is contracted to may deduct withholding tax on their behalf. EzineArticles.com allows expert authors in hundreds of niche fields to get massive levels of exposure in exchange for the submission of their quality original articles. contractor (Former Employee) - Knoxville, TN - March 28, 2022. In the US, there are basically two types of employment: 1099 and W-2. In a traditional employer-employee relationship, you're responsible for paying 7.65% of your income to these programs and your employer matches it with an additional 7.65%. Contracting To Permanent Calculator Hiring a new employee who will get paid in part or in whole on commission. Performance-linked incentives agreement compensation template sample form philippines canada forms india usa legal canadian pdf templates brazil contracts documatica samples email agreements Someone hires you and youre going to get paid on commission. So, I am unable to share it with you. A performance-linked incentive (PLI) is a form of incentive from one entity to another, such as from the government to industries or from an employer to an employee, which is directly related to the performance or output of the recipient and which may be specified in a government scheme or a contract.PLI may either be open-ended which does not have a fixed ceiling for the Search: Mpu9250 Spi Driver. Independent Contractor: Definition and Examples Alabama 1099 vs. W2 Employee: Making the Right Choice. Business Expenses Still, its important to make sure you have all the information you need and your bases covered before making this decision. The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. For IT contractor companies to discuss business and contract opportunities. Copy and paste this code into your website. contractor Hiring: Contractors vs employees business.govt.nz Unpaid Wages Hiring a new employee who will get paid in part or in whole on commission. Pay Stub Templates in Google Docs | Google Hiring a contractor can be a good idea if your business: is short of a specific skill; only needs help for a specific period, eg for a one-off project; wants someone at short notice. mexico salary construction Once I have a job, Ive already agreed that the salary is adequate, or else I wouldnt have accepted the job offer. QuickBooks Independent Contractor: An independent contractor is a self-employed taxpayer who controls his own employment circumstances, including when and how work is done. QuickBooks Assignment Essays - Best Custom Writing Services Mediagazer Pension:If you currently have a pension enter the amount that you pay into the pension on a regular basis.This can be entered in a percentage format e.g. wages wage allowances learnerships I was so excited to start work, my first client was roleplaying to help train insurance agents. Ensure every employed independent contractor, colleague, and other employees know the monthly deduction through our free pay stub templates in Google Docs.Each check stub lets you quickly write a sample statement or sample invoice for a small business or large corporation in construction, manufacturing, and other sectors during E.g. The Hollywood Reporter Contractor Calculator, the UKs authority on contracting serves a readership of over 200,000 visitors per month [see latest traffic report] made up of contractors from IT, telecoms, engineering, oil, gas, energy, and other sectors. Through Johns Hopkins EAP (JHEAP) you and your household family members have 24/7 telephone access to a daily life assistance counselor by calling 888-978-1262 and asking for resources and referrals for child care, elder care, pet care, parenting issueseven household help, such as finding a contractor. Was going through a difficult time in my life while I was employed here. inequality wage unions decline sourced illustrates thesocietypages ssn Occupational Employment and Wage Estimates construction salaries builder salary florida remain flat management pay chart industry building highest many business workers compensation shows states related Workers who have independent contractor status pay both employee and employer self-employment taxes. A contractor generally pays their own tax directly to the IR. Contracting To Permanent Calculator Mediagazer 7 June 2022. W2 Employee vs. 1099 Employee: What's The Difference Still, its important to make sure you have all the information you need and your bases covered before making this decision. This means that your self-employment tax is 15.3%. This means that your self-employment tax is 15.3%. 18.3.1 Employee and Independent Contractor Data Entry; 18.3.2 Customer Data Entry; 18.3.3 General Data Entry Terms; 18.4 Account Security; You may make changes to your default payment method in the App by going to the Account Information section of the My Account menu. In a traditional employer-employee relationship, you're responsible for paying 7.65% of your income to these programs and your employer matches it with an additional 7.65%. Now is a pivotal time for the workplace and workforce as critical issues affecting society impact work. Reviews That way, you can compare the salary for each role to each other role. The agreement would help clarify all the terms of the employment. Indeed.com This is also depending on the authorized treating physician's approval of the missed days from work. salary slip template excel word sample templates formats related Reviews To qualify for BADR, the company must be a personal trading company with you either an employee or a director. architecture salary graduate jobs construction employability catering drink average chart In special situations the company or person the contractor is contracted to may deduct withholding tax on their behalf. Was going through a difficult time in my life while I was employed here. For IT contractor companies to discuss business and contract opportunities.

Federal government websites often end in .gov or .mil. OR Someone hires you and youre going to get paid on commission. agreement salary form reduction pdffiller printable forms We welcome your comments about this publication and your suggestions for future editions. In special situations the company or person the contractor is contracted to may deduct withholding tax on their behalf. EzineArticles.com allows expert authors in hundreds of niche fields to get massive levels of exposure in exchange for the submission of their quality original articles. contractor (Former Employee) - Knoxville, TN - March 28, 2022. In the US, there are basically two types of employment: 1099 and W-2. In a traditional employer-employee relationship, you're responsible for paying 7.65% of your income to these programs and your employer matches it with an additional 7.65%. Contracting To Permanent Calculator Hiring a new employee who will get paid in part or in whole on commission. Performance-linked incentives agreement compensation template sample form philippines canada forms india usa legal canadian pdf templates brazil contracts documatica samples email agreements Someone hires you and youre going to get paid on commission. So, I am unable to share it with you. A performance-linked incentive (PLI) is a form of incentive from one entity to another, such as from the government to industries or from an employer to an employee, which is directly related to the performance or output of the recipient and which may be specified in a government scheme or a contract.PLI may either be open-ended which does not have a fixed ceiling for the Search: Mpu9250 Spi Driver. Independent Contractor: Definition and Examples Alabama 1099 vs. W2 Employee: Making the Right Choice. Business Expenses Still, its important to make sure you have all the information you need and your bases covered before making this decision. The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. For IT contractor companies to discuss business and contract opportunities. Copy and paste this code into your website. contractor Hiring: Contractors vs employees business.govt.nz Unpaid Wages Hiring a new employee who will get paid in part or in whole on commission. Pay Stub Templates in Google Docs | Google Hiring a contractor can be a good idea if your business: is short of a specific skill; only needs help for a specific period, eg for a one-off project; wants someone at short notice. mexico salary construction Once I have a job, Ive already agreed that the salary is adequate, or else I wouldnt have accepted the job offer. QuickBooks Independent Contractor: An independent contractor is a self-employed taxpayer who controls his own employment circumstances, including when and how work is done. QuickBooks Assignment Essays - Best Custom Writing Services Mediagazer Pension:If you currently have a pension enter the amount that you pay into the pension on a regular basis.This can be entered in a percentage format e.g. wages wage allowances learnerships I was so excited to start work, my first client was roleplaying to help train insurance agents. Ensure every employed independent contractor, colleague, and other employees know the monthly deduction through our free pay stub templates in Google Docs.Each check stub lets you quickly write a sample statement or sample invoice for a small business or large corporation in construction, manufacturing, and other sectors during E.g. The Hollywood Reporter Contractor Calculator, the UKs authority on contracting serves a readership of over 200,000 visitors per month [see latest traffic report] made up of contractors from IT, telecoms, engineering, oil, gas, energy, and other sectors. Through Johns Hopkins EAP (JHEAP) you and your household family members have 24/7 telephone access to a daily life assistance counselor by calling 888-978-1262 and asking for resources and referrals for child care, elder care, pet care, parenting issueseven household help, such as finding a contractor. Was going through a difficult time in my life while I was employed here. inequality wage unions decline sourced illustrates thesocietypages ssn Occupational Employment and Wage Estimates construction salaries builder salary florida remain flat management pay chart industry building highest many business workers compensation shows states related Workers who have independent contractor status pay both employee and employer self-employment taxes. A contractor generally pays their own tax directly to the IR. Contracting To Permanent Calculator Mediagazer 7 June 2022. W2 Employee vs. 1099 Employee: What's The Difference Still, its important to make sure you have all the information you need and your bases covered before making this decision. This means that your self-employment tax is 15.3%. This means that your self-employment tax is 15.3%. 18.3.1 Employee and Independent Contractor Data Entry; 18.3.2 Customer Data Entry; 18.3.3 General Data Entry Terms; 18.4 Account Security; You may make changes to your default payment method in the App by going to the Account Information section of the My Account menu. In a traditional employer-employee relationship, you're responsible for paying 7.65% of your income to these programs and your employer matches it with an additional 7.65%. Now is a pivotal time for the workplace and workforce as critical issues affecting society impact work. Reviews That way, you can compare the salary for each role to each other role. The agreement would help clarify all the terms of the employment. Indeed.com This is also depending on the authorized treating physician's approval of the missed days from work. salary slip template excel word sample templates formats related Reviews To qualify for BADR, the company must be a personal trading company with you either an employee or a director. architecture salary graduate jobs construction employability catering drink average chart In special situations the company or person the contractor is contracted to may deduct withholding tax on their behalf. Was going through a difficult time in my life while I was employed here. For IT contractor companies to discuss business and contract opportunities.

00 P&P + 3 Last released Oct 11, 2017 MicroPython SPI driver for ILI934X based displays This is not needed when using a standalone AK8963 sensor An IMU (Inertial Measurement Unit) sensor is used to determine the motion, orientation, and heading of the robot Data is latched on the rising edge of SCLK Data is latched on the rising Pros. pay template stub contractor Average salary at Northrop Grumman; Average salary in US; Career advice; They work me with more than a reasonable amount of time. Liveops Step 3. During the Great Depression, the league was under financial pressure to lower its salary cap to $62,500 per team and $7,000 per player, forcing some teams to trade away well-paid star players in order to fit the cap.. Pre-salary cap. Many times companies decide to decrease or cutoff the employee salary due to recession, losses, lower profits from the company side. contractor Companies also cutoff employee salaries due to weak performance, no target achievements etc. Read our visual guide to employee types. Now is a pivotal time for the workplace and workforce as critical issues affecting society impact work. Contractors can typically demand a higher salary - the figure is roughly reported as being 15% more in comparison to a permanent employee. Hiring: Contractors vs employees business.govt.nz A contractor generally pays their own tax directly to the IR.

00 P&P + 3 Last released Oct 11, 2017 MicroPython SPI driver for ILI934X based displays This is not needed when using a standalone AK8963 sensor An IMU (Inertial Measurement Unit) sensor is used to determine the motion, orientation, and heading of the robot Data is latched on the rising edge of SCLK Data is latched on the rising Pros. pay template stub contractor Average salary at Northrop Grumman; Average salary in US; Career advice; They work me with more than a reasonable amount of time. Liveops Step 3. During the Great Depression, the league was under financial pressure to lower its salary cap to $62,500 per team and $7,000 per player, forcing some teams to trade away well-paid star players in order to fit the cap.. Pre-salary cap. Many times companies decide to decrease or cutoff the employee salary due to recession, losses, lower profits from the company side. contractor Companies also cutoff employee salaries due to weak performance, no target achievements etc. Read our visual guide to employee types. Now is a pivotal time for the workplace and workforce as critical issues affecting society impact work. Contractors can typically demand a higher salary - the figure is roughly reported as being 15% more in comparison to a permanent employee. Hiring: Contractors vs employees business.govt.nz A contractor generally pays their own tax directly to the IR.  Based upon an approved claim, and after the 3-day waiting period, payment will be 66 2/3% of the employee's average weekly wage subject to the maximum and minimum. For an employee, the employer pays PAYE tax and ACC on the employees behalf, and the employee is paid net wages or salary. If the employee is paid an hourly wage of $9.25 per hour and worked 30 hours in the workweek, the maximum amount the employer could legally deduct from the employee's wages would be $60.00 ($2.00 X 30 hours), so the full $15.00 deduction for the cash register shortage would be allowed under law. Employee Resignation Forms (Special rules Amended Hong Kong information in 'Countries G to P: applying for a criminal records check for someone from overseas' - the new policy comes into effect on 8 June rather than 1 June. Ensure every employed independent contractor, colleague, and other employees know the monthly deduction through our free pay stub templates in Google Docs.Each check stub lets you quickly write a sample statement or sample invoice for a small business or large corporation in construction, manufacturing, and other sectors during Amended Hong Kong information in 'Countries G to P: applying for a criminal records check for someone from overseas' - the new policy comes into effect on 8 June rather than 1 June. Independent contractor. Your Link Labour-hire firms and their workers What Is Your Current Salary salary 2. Employee or contractor; Employees. This means that your self-employment tax is 15.3%. Liveops Based upon an approved claim, and after the 3-day waiting period, payment will be 66 2/3% of the employee's average weekly wage subject to the maximum and minimum. contractor (Former Employee) - Knoxville, TN - March 28, 2022. Topics: 13,864 Posts: 224,690 Last Post: Insurance to cover contractors abroad So, I am unable to share it with you. In special situations the company or person the contractor is contracted to may deduct withholding tax on their behalf. (Special rules In private sector employment, the exempt employees salary may not be reduced when an employee is absent for part of a day, unless the absence qualifies as leave taken under the federal Family and Medical Leave Act (FMLA). payslip Inform Employee of Salary Decrease See My Options Sign Up Answer (1 of 26): Any matters related to compensation and other monetary affairs need to be clear, in detail and to the point.

Based upon an approved claim, and after the 3-day waiting period, payment will be 66 2/3% of the employee's average weekly wage subject to the maximum and minimum. For an employee, the employer pays PAYE tax and ACC on the employees behalf, and the employee is paid net wages or salary. If the employee is paid an hourly wage of $9.25 per hour and worked 30 hours in the workweek, the maximum amount the employer could legally deduct from the employee's wages would be $60.00 ($2.00 X 30 hours), so the full $15.00 deduction for the cash register shortage would be allowed under law. Employee Resignation Forms (Special rules Amended Hong Kong information in 'Countries G to P: applying for a criminal records check for someone from overseas' - the new policy comes into effect on 8 June rather than 1 June. Ensure every employed independent contractor, colleague, and other employees know the monthly deduction through our free pay stub templates in Google Docs.Each check stub lets you quickly write a sample statement or sample invoice for a small business or large corporation in construction, manufacturing, and other sectors during Amended Hong Kong information in 'Countries G to P: applying for a criminal records check for someone from overseas' - the new policy comes into effect on 8 June rather than 1 June. Independent contractor. Your Link Labour-hire firms and their workers What Is Your Current Salary salary 2. Employee or contractor; Employees. This means that your self-employment tax is 15.3%. Liveops Based upon an approved claim, and after the 3-day waiting period, payment will be 66 2/3% of the employee's average weekly wage subject to the maximum and minimum. contractor (Former Employee) - Knoxville, TN - March 28, 2022. Topics: 13,864 Posts: 224,690 Last Post: Insurance to cover contractors abroad So, I am unable to share it with you. In special situations the company or person the contractor is contracted to may deduct withholding tax on their behalf. (Special rules In private sector employment, the exempt employees salary may not be reduced when an employee is absent for part of a day, unless the absence qualifies as leave taken under the federal Family and Medical Leave Act (FMLA). payslip Inform Employee of Salary Decrease See My Options Sign Up Answer (1 of 26): Any matters related to compensation and other monetary affairs need to be clear, in detail and to the point.